Why your marketplace could be at risk from malicious attacks and what we’re doing to combat them.

As marketplaces continue to make themselves the epicenter of seller productivity, they’re seeing a simultaneous rise in malicious attacks, prompting the question: how can you maintain global growth while effectively executing fraud prevention?

Given that more and more marketplaces are now becoming payment facilitators for their sellers by embedding payments, the level of risk involved has risen exponentially. While intuitive and eminently scalable, it broadens the scope for malicious attacks in several ways that can result in financial and reputational damage for the marketplace.

For the purpose of this blog, we will focus on marketplaces and how to prevent these attacks from causing significant damage. It’s worth noting that most of the fraud that plagues marketplaces can occur across any multi-sided business facilitating payments. This is particularly true for seller fraud, which we will spotlight in this blog, and how, in a platform environment, malicious users engage in dangerous activity through the guise of genuine sellers.

The risk landscape for marketplace

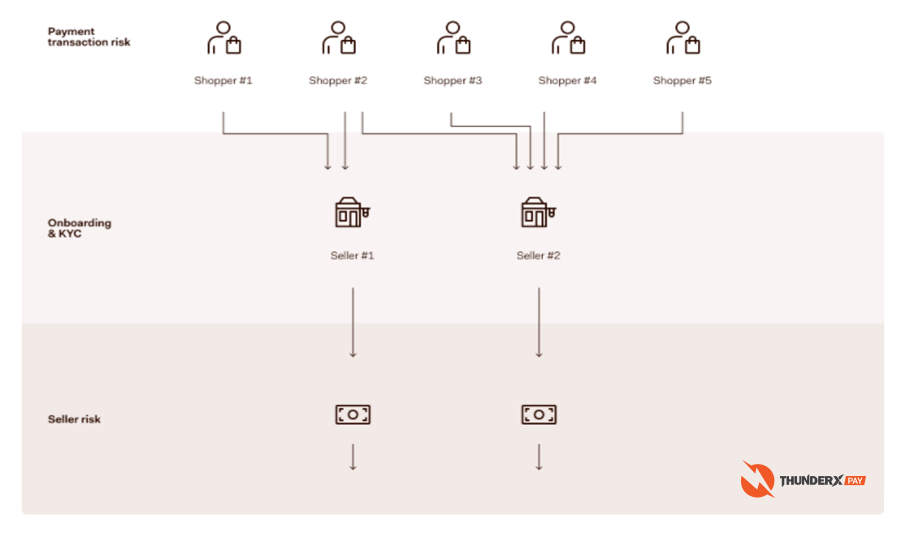

The cruel reality is; the more a marketplace grows, the greater the likelihood of fraud from both buyers and sellers. The approachability and accessibility of the model, (which are, ironically, why it’s becoming so popular), are the very reasons it’s more susceptible to fraud. But what, exactly, is the risk involved? For marketplaces, it’s three layers deep:

Payment transaction risk

When a customer (e.g. shopper) completes a purchase. This is what we know as “traditional risk”, where the fraudster pays for goods or services using stolen credit card details.

Onboarding & Know Your Customer (KYC) risk

This occurs when a new seller signs up to the platform. Using permutations of false information and with enough attempts, fraudsters can create real seller accounts.

Seller’s Risk

This arises once a seller has signed up and is operating on the platform. And we explore its pervasive nature in the rest of this blog.

Today, we will narrow in on seller risk and fraud, which have become a recent and far greater burden because of the rapid rise of the platform business model. While relatively lesser well known, it can quickly threaten the safe and consistent running of a marketplace.

What is seller fraud?

Seller fraud occurs when a seller has been onboarded and is operating maliciously in the marketplace while feigning authenticity. The practice has become a tricky adversary to the scaling of marketplaces. The struggle to combat seller fraud while creating a seamless sign-up and onboarding experience is becoming increasingly difficult, given how easy it is for sellers to create new accounts.

The opportunities to skirt the system during KYC checks are unfortunately numerous, but with a smart risk tool, your visibility increases dramatically.

Malicious users hide their activity across multiple accounts or simply return for more tries when one avenue fails. We’ve found from data on our platform that Score finds on average two linked accounts for every malicious account discovered.

If there’s one thing that can really scupper a period of long-sought growth, it’s fraud. And by fraud today, we’re not just referring to the card scammers of old, but hyper-sophisticated and cruelly robust fraud:

Account takeovers

Takeovers are a growing trend among fraudsters, whereby they gain access to a genuine seller’s account using stolen or dark web sold credentials and extract funds or perform scams.

Collusion

The seller and buyer are one and the same. The accounts process stolen credit cards or process illegally acquired funds and use the marketplace to move money from A to B efficiently and effectively.

Fraud rings

Using false personally identifiable information, many seller accounts are created to spread their fraudulent activity over multiple accounts to stay under the radar. For large marketplaces, there is on average a 37% chance that a flagged fraudulent account is connected to more accounts, highlighting the use of fraud rings by criminals.

Synthetic fraud

When a user combines real personal data with fake information to create new identities. This information is used to open fraudulent accounts.

Platform abuse

Scams (e.g. fake listings, items not delivered) are performed through the platform to steal funds or personal information; or platform policies are abused (e.g. refund fraud, artificially establishing seller reputation).

For marketplaces with many users, seller fraud can become a serious financial problem, as fraud schemes of old were typically associated with compliance. The difference today is the scale, with money flowing to fraudsters presenting a hefty financial loss for the marketplace. And in a world where social media and 24-hour news cycles prevail, reputational damage from attacks is a far greater problem.

How Score tackles marketplace fraud prevention

Evidently, the lengths to which fraudsters will go to infiltrate your marketplace are limitless. But so too are the lengths we’re going to stop them.

We noted the constant battle marketplaces and platforms are in with fraudulent users, and looked to create a mechanism that would allow us to combat this rise in malicious activity. A smart feature that would learn from the experiences of merchants across all industries dealing with fraud; would be better able to scupper these attacks. And that’s Score.

Using Adyen’s internal network analysis and machine learning models, Score detects unusual behavior of platform users, creates risk signals, and assigns scores to users based on malicious activity.

If you have a strong risk management infrastructure in place, it can spot and block fraudsters before payout, as well as adapt to their new strategies and behaviors as they evolve. This new technology allows your fraud and compliance teams to gain unparalleled visibility and easily take action in the fight against active fraudsters in the marketplace.

How Score works

Feature | Function |

|---|---|

Transaction monitoring | Receive alerts, derived from machine learning algorithms, on unusual seller transaction activity patterns. The platform can reduce chargebacks due to seller/buyer collusion and scams. |

Risk score per user | Leverage a dynamic and configurable risk score per user and prioritize risk management based on the degree of ‘unusualness’. Automatically stop the payout to a seller who has crossed your risk score threshold. |

Risk signals customizer | Configure your marketplace rules, applicable to your users based on transaction and KYC data. We monitor for rules being broken and send you early warnings for known risk scenarios. |

Cross-platform high risk lists | Get alerted if a user shows a KYC attribute (e.g. bank account number). |

Network analysis | See links between platform users to identify returning malicious users, synthetic fraud, and fraud rings. |

The costs associated with outdated risk tooling go beyond those incurred in payouts and refunds. When a platform is perceived as susceptible to weakness, the damage is quick and becomes an enduring financial problem. Fines can amass quickly for certain types of fraud; buyers’ trust, once lost, proves very difficult to get back; and legitimate sellers will go elsewhere.

Marketplaces are hubs for innovation, globalization, and they create opportunities for small or solo businesses to thrive in verticals where they’ve previously been overlooked. They have changed the way we buy and sell. Instead of allowing fraud to become part and parcel of your marketplace and chip away at the brand, tackle it proactively and comprehensively with smart tooling. This approach will ensure your business can continue growing, and will allow your buyers and sellers to interact freely and without worry.

Published 14/02/2022

By Michael Saichuk