Nowadays, many situations are being fluctuated in each microeconomics around the world. Not only the increased cost of living but also the other causes that Laos has faced in this severe situation which lead to an economic crisis. It was begun with Laos’ public debt, fuel shortage, and depreciation of the Kip currency has down 36% against the dollar over the last year, 2021, together with inflation. Our analyst team mentioned the Laos inflation statistic compared in the same period in April to March from 5 years (2017), to last year (2021), and this year (2022)

Firstly, The inflation rate, In 2017, 5 years ago, The Bank of the Lao P.D.R reported an inflation rate of 1.52% in April, and the inflation rate decreased to 1.07% in May with the 6.83% of 2017 GDP, According to the report from CEIC Data. In the same period month last year in April 2021, the inflation rate was 3.23% and in May 2021 the inflation rate was 3.55%, this is the highest point in 15 years. In 2021, Lao’s GDP was 3.47% which expanded by 3.5% in the previous year, in 2020 it was 3.27%. According to the latest statistic from the Bank of Laos, the inflation rate in May 2022 rose to 12.81% which increased from 9.86% in April compared to a percentage of 76.97% within 1 month.

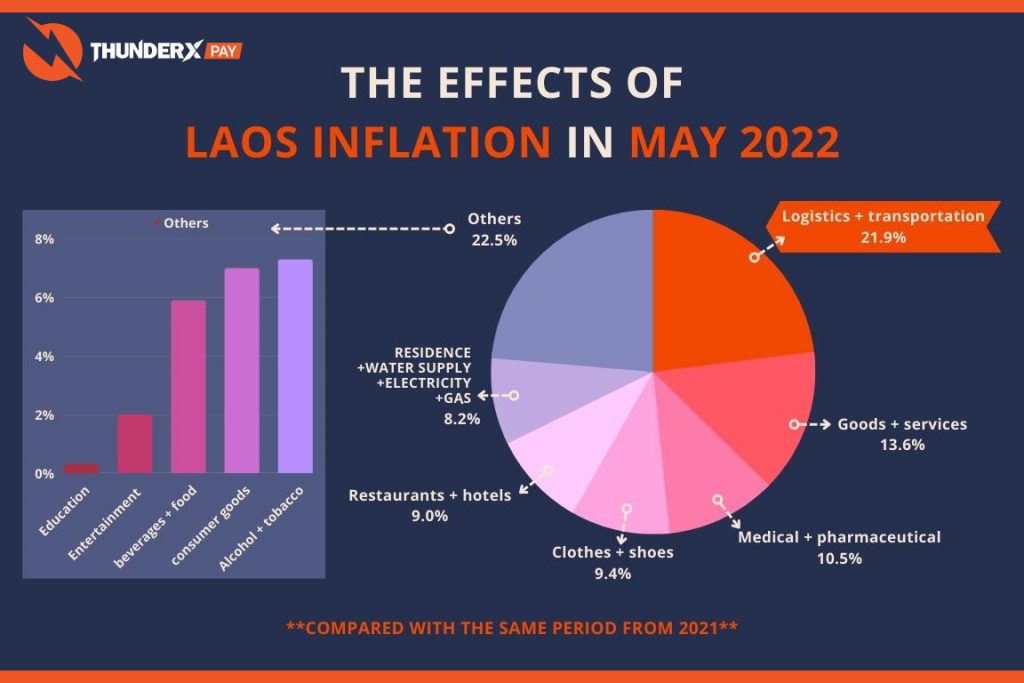

The effects of inflation in May 2022 are 11 categories as below;

Logistics and transportation 21.9%

Goods and services 13.6%

Medical and pharmaceutical 10.5%

Clothes and shoes 9.4%

Restaurants and hotels 9.0%

Residence, water supply, electricity, and gas 8.2%

Alcohol and tobacco 7.3%

Consumer goods 7.0%

Non-alcoholic beverages and food 5.9%

Entertainment and satisfaction 2.0%

Education 0.3%

For that reason, the Prime Minister of Laos assigned 8 senior officials to the task force which the group involves the Minister of Industry and Commerce, The Governor of the Bank of the Lao PDR, The Head of the Office of the Party Central Committee, The Deputy Head of the Government Inspection Agency, the Chief of the Police Department under the Ministry of Public Security, and the President of the Lao Fuel and Gas Association. The task force will be required to take measures to ensure that the country’s fuel demand is met, including ensuring that fuel prices are firmed on time, and in correspondence with global market fluctuation. Meanwhile, the members will set the procedure to provide a foreign currency, manage exchange rates, and sour out the problems in currency exchange trading to affirm macroeconomic stability.

Not only did the inflation rate effected to Lao’s economic crisis but also Laos’ public debt in August 2021, The World Bank reported the debt has climbed to the U.S. $13.3 billion, or 72 percent of its gross domestic product with about haft of the amount owed to China which started from Laos has built dozens of hydropower dams on the Mekong and later on the mega project which is China-Laos railways that its obligation includes loans to funds its 30% share of the $5.9 billion. It has been costed massive debt problems in Laos which the government engaged in discussions and negotiations not only with China but also with Vietnam, Japan, Asia Development Bank, World Bank, and other countries that offer loans and support the Lao People’s Democratic Republic, said the Lao Finance Minister Bounchom Oubonpaseuth. Lao PDR’s government debt is among the highest in the region, at about 71% of GDP in 2021.

Moreover, The causes of these economic crises, the recent depreciation might reflect dangerously weak macro fundamentals and exert greater pressure on Lao PDR’s external instability. In addition, if the depreciation is primarily due to low foreign exchange reserves, it could indicate an acute shortage of foreign exchange reserves, ultimately triggering a balance of payments crisis. Currently, the risk of the crisis however is assessed to be medium with the assumption that the country could roll over the existing external debts.

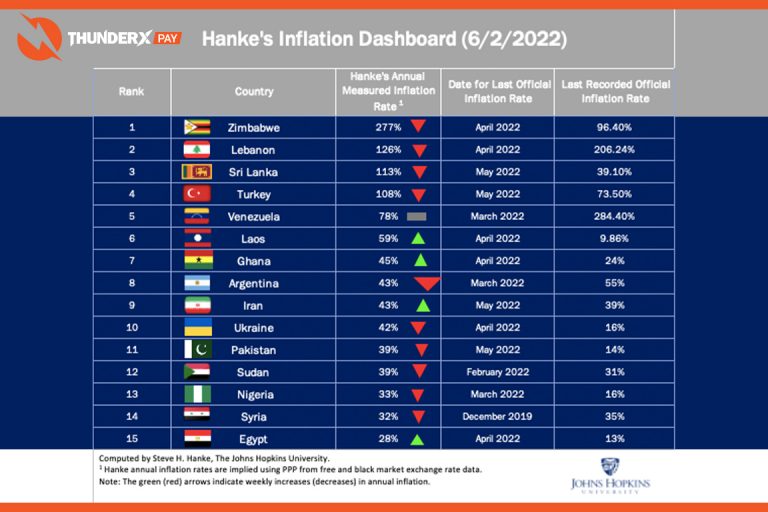

Laos has one of the highest inflation rates in Southeast Asia and was ranked No.6 in April 2022 in the list of the most inflation in the world. The latest news (14/06/2022) announced that The Central Bank of The Lao P.D.R recommended banning people in Laos to not holding foreign currencies which are connected to problems of Kip depreciation and rising inflation. Therefore, the central bank would implement the measures to ensure foreign currency enters the economy at an appropriate volume and enters the banking system or institute measures facilitating the bank’s purchasing of larger volumes of foreign currencies to better meet the demands of individuals and businesses.

Published 15/06/2022

By Windy K.