Nowadays, Payment gateways have been used to accept purchases from customers, potentially growing the merchant business. It is a tool used by merchants to receive payments from customers which is cloud-based and it helps merchants receive online payments from customers. Moreover, a brick-and-mortar retail store’s payment gateway is a point-of-sale (POS) system. Globalization drives businesses to transact more frequently across borders. Consumers are also transacting more globally buying from foreign eCommerce sites and traveling, living, and working abroad. E-commerce and other online transactions are growing even more rapidly since the beginning of the COVID-19 pandemic, with particularly strong trends across many emerging markets.

What is a payment gateway?

A payment gateway is a technology used by merchants to accept any payment method from customers provided by an e-commerce application service provider to which a merchant’s website or a physical point-of-sale POS system is connected. A payment gateway often connects several acquiring banks and payment methods under one system. It transmits transaction information virtually through web payment services and APIs or in-person through a payment terminal. It is the link between the front end and the back end of payment. It is the interface through which the customer pays and through which the merchant collects payment.

Payment gateways are specifying differentiated from payment processors, which use customer information to collect payments on behalf of the merchant. Some payment gateways also support cross-border online payments, making it easier for aspiring business owners to scale their eCommerce at the international level. Using it is the opportunity for selling globally online is growing faster than ever before.

What is a payment service provider?

Payment service providers (or PSPs) are companies that provide a variety of services to a business to help them get paid. They commonly provide both a merchant account and a payment gateway to a business, helping the business collect and manage its payments. Payments go to the PSP and are then transferred on to you.

How does a payment gateway work?

A payment gateway is a link between different components of a payment transaction. The payment gateway’s job is to collect payment data, encrypt it, and send it to the payment processing network. Some payment gateway technologies also provide built-in payment processing capabilities, as well as advanced security and payment optimization features.

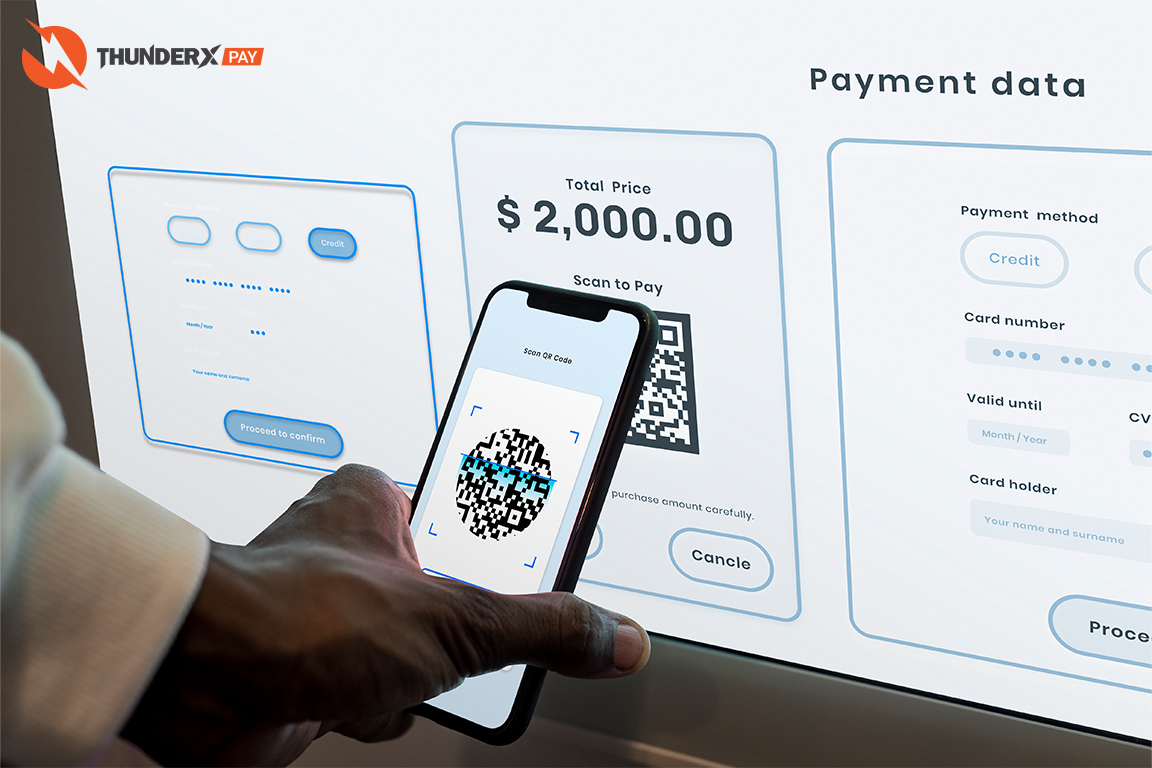

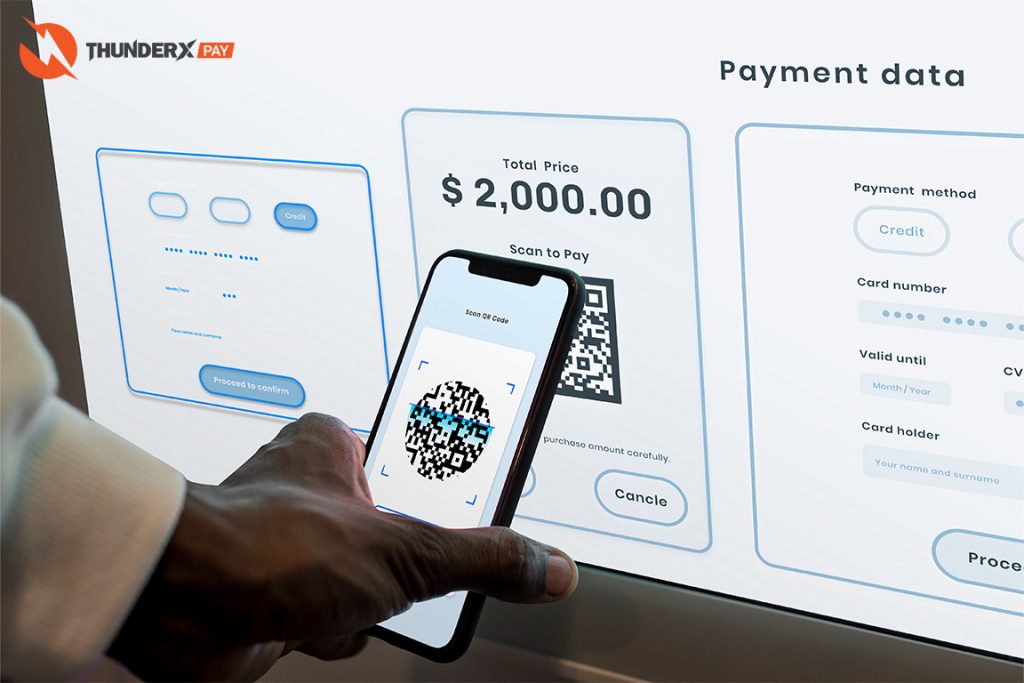

The payment gateway may be provided by a bank to its customers but can be provided by a specialized financial service provider as a separate service, such as a payment service provider. ThunderXpay is one of the payment gateways that promote payment transactions which reliable by which under the regulations of the Bank Of Thai (BOT). We provide a QR code solution, which is the easiest transaction and the most popular payment method in Southeast Asia the client enables to transfer money across the country by using the application mobile banking to scan for depositing and withdrawal back to their bank account without any charge.

ThunderXpay makes the world of business connect. It lets payment become easy, secured, and no-condition. It allows your client to proceed with any transaction from anywhere, anytime with more than one hundred thousand users trusted by many authorized companies, together with more than a hundred thousand users.

Published 29/08/2022

By Ashley Jones