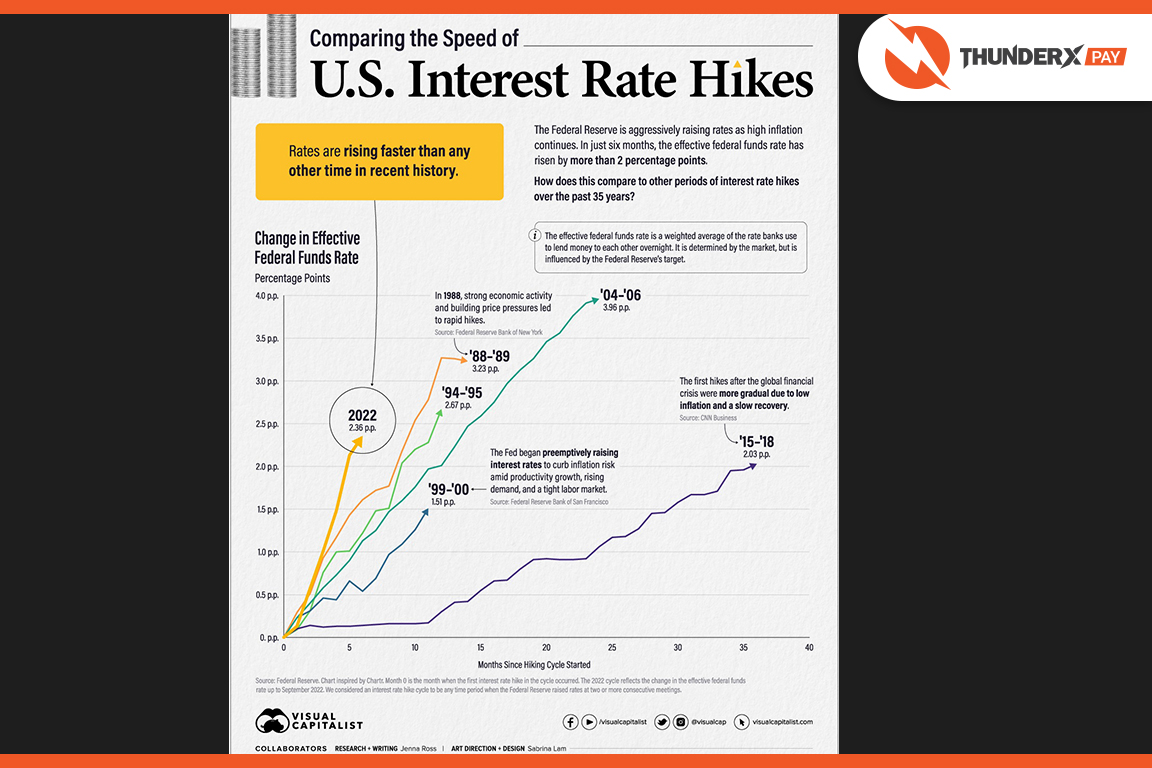

On 2 November 2022, FED stepped up its fight against a 40-year high in US inflation by announcing a 0.75 percent point raising the interest rate. The moves aimed at inflation may soon slow down with the cost of living crisis suffering consumers. Powell was speaking after the Federal Open Market Committee voted unanimously to increase the federal funds rate to a target range of 3.75% to 4% as it’s the highest level since 2005.

The impact of raising interest rates takes time to be adjusted through to the wider economy. Meantime, the US real estate market appears to be slowing down but the employment rate remains powerful. However, When the Fed raises interest rates it becomes more expensive for banks to borrow money from one another. Banks pass on these higher rates to consumers by making it more expensive for them to get a mortgage, or a loan, pay off credit card debt, and more.

In addition, The Fed’s predictions show a possible hike of half a percentage point at the next meeting in December, followed by a smaller hike in early 2023. While the Fed’s meeting occurred as financial markets and many economists have grown nervous that Chair Jerome Powell will end up leading the central bank to raise borrowing costs higher than needed to follow inflation and will cause a painful recession in the process.

Published 09/11/2022

By Ashley Jones