4 payment points to plot on your roadmap for growth

Break free from your existing thought patterns and explore new avenues for revenue creation.

In times like these, it can be difficult to find the headspace to map out your business growth. It’s difficult to know where to start. What you need is a framework. In 2000, three McKinsey consultants published The Alchemy of Growth: Practical Insights for Building the Enduring Enterprise. In it, they present a model that invites business owners to open their minds and break free from existing thought patterns. It’s called The Seven Degrees of Freedom for Growth, and it provides a framework intended to help businesses broaden their horizons.

.

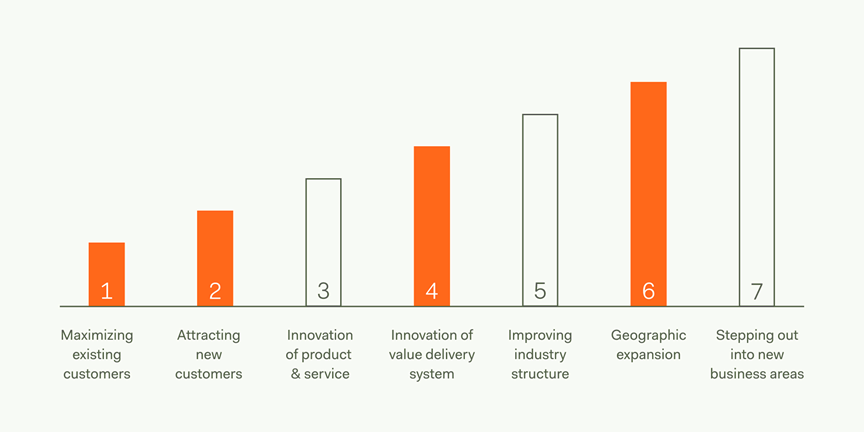

McKinsey’s Seven Degrees of Freedom for Growth

Payments can be one of those unobvious opportunities for growth that can be a real driver of your expansion plans. It can easily be mapped to at least four of the seven degrees shown above. We’ll look at how your payment platform can play a part in planning your growth.

Maximizing existing customers

Step one in any growth plan is to work out how you can sell more to those you already sell to. Your customers know who you are and what you offer. Now it’s a matter of increasing the frequency of their purchases. Payments can be an essential tool in your efforts.

Know thy customer: Selling more means getting to know your customers better. How and where your customers pay are two of the most fundamental characteristics you should know. For example, do they use Apple Pay on mobile but a debit card in store? An effective payments partner can identify your customers’ preferred methods and ensure you can offer the whole range of them, both online and offline.

Maintaining loyalty: There’s never been a more important time to build meaningful relationships with your customers. 73% of global consumers said that they would continue to favor the businesses they relied on during the pandemic. If the payments data between your digital and physical channels is connected, you can build a centralized view of your customers and in turn tailor your communications to specific customers. For example, you could send an email with a 10% discount on the day of the month they tend to spend the most.

Practical tip

Avoid not linking card details to shoppers | Instead connect data identifiers with payment data. This will enable: | Card acquisition and payment requests can return several customer identifiers. It‘s up to you which of these identifiers you want to use. | Passive customer recognition: Customer origin data can help you decide if you should accept new payment methods, offer currency conversion on your terminals, or add signage in other languages in your shop. |

|---|---|

Active customer recognition: Engage recognized customers by personalizing their shopping experience. Add points to the shopper’s loyalty account, or you can apply this before a payment to award a discount or a loyalty gift on the spot. | |

Tokenization for recurring online payments: Use when cross-selling products that require regular payments, such as an insurance policy for a product that the customer bought in your store. |

Attracting new customers

You’ve figured out how to encourage increased spending from existing customers, now it’s time to look further afield and attract new ones. Understanding them is the first step, which can be made easier by using market segmentation to divide your market into niche groups. This will help you develop targeted marketing campaigns to cater to the needs of each group. Segmentation is traditionally done by these four categories:

- Demographics

- Behavioural

- Psychographic

- Geographic

Knowing where, how much, how often, and how your customers shop can be invaluable in building a detailed picture of your potential new customers. Payment identifiers can help with adding more detail to your behavioral and geographic groupings. For example:

- Location: i.e offering Girocard in Germany will help conversions in that region

- Payment method preference: credit cards, debit cards, wallets

- Average spend amount: high – low

- Spend frequency: often – rarely

You can also use payment data to increase your share of customers in segments that may be underperforming. For example, adding a mobile responsive checkout and accepting wallet based payments will lead to an increase in conversions among Gen Z.

Payment data can help you map out and define customer segments so you can:

- Accurately target these groups

- Deliver superior value to each of them

Innovation of value delivery system

Evaluating and redesigning the system by which your product or service is delivered to customers can also drive growth. We found that 7 in 10 shoppers abandoned an online shopping cart at least once in the past six months due to difficulties completing a purchase, resulting in a staggering figure of £257bn in lost annual sales.

Delivering a superior payment experience ensures you can generate as much revenue as possible from your existing customers as well as those new ones you’ve worked so hard to attract. This can be done by optimizing your purchase funnel and payment page. From offering one-click payments to auto-filling personal information into forms, there are a variety of ways to create a more enjoyable checkout experience.

Avoid | Instead |

|---|---|

Redirecting, if not relevant: Forwarding customers to a payment page that isn’t hosted by you can arouse suspicion | Go native: This will increase trust and boost conversions since it minimizes steps to payment. If you have an app, go for in-app payments instead of a redirect.

OR

Targeted redirect: If you have a variety of use cases where there’s 1:1 interaction – including chatbots, social media, and telephone – opt for a Pay by Link redirect. This will ensure a smooth and branded experience that completely fits your conversational commerce strategy with conversion in mind.

|

Bombarding customers with options: Just because you can offer 100 payment methods, it doesn’t mean you should. | Shortlist: Pick your top 5, which will usually include the locally preferred options (e.g. cards or bank transfers) + wallet options. Adyen builds this logic into your checkout so you offer what matters. This will ensure customers can seamlessly jump to the next step of completing the payment. |

Geo expansion

Payments can help you expand distribution in existing markets while also making an impact in new ones. Here are two examples of how we’ve helped merchants remain compliant and grow into new regions.

Up to date in existing markets

Even if you know your market inside-out, you can’t be expected to know everything about payments regulations. Your payment provider may have the local expertise that you might lack and can keep you up to date with all the latest developments in your market.

For example, a recent Swedish law dictated that the first payment option shown on a checkout page could not be a credit option. In other countries, this is common. If you were a merchant operating in Sweden, we’d seamlessly factor this change into your checkout logic.

Global expansion through local QR Code payment methods

Once you integrate with Thunder X Pay, you can take advantage of our local payments technology and in-depth knowledge of QR Code payment options. Every market has nuances and favourite ways of payment. While QR Code payments are very popular across the kingdom of Thailand, Cambodia, Myanmar and Laos, other payment options like online banking, open invoice, and local card schemes dominate in other markets.

How Do QR Codes Work?

There are a few different models, but the principle is simple. In most models, the merchant presents a QR code to the consumer. The consumer snaps an image of the code on their smartphone camera, and this takes them to a payment page, similar to the payment page they would see with a mobile commerce transaction.

The consumer then authenticates the transaction and a message is sent back to the merchant to confirm payment. A message is also shown on the consumer’s phone so that they can show the cashier that the payment is complete. That’s it.

Thunder X pay has been brilliant. We provided data to inform our decisions around QR Code payment options, and implementation was very straightforward.

Published 04/02/2022

By Michael Saichuk