According to the detailed research of our analytic team, the anticipated recovery of the Brunei economy in 2021 has been derailed by the materialization of key downside risks—pandemic resurgence, unanticipated domestic oil and gas production disruptions, and delays in the commencement of FDI projects.

Domestic economic activity has been severely impacted by the re-imposition of containment measures. The Brunei economy shrank by 2.2 percent year on year in the third quarter of 2021, the fourth consecutive quarterly decline. Upstream and downstream oil and gas production have been weaker than expected, while some service activities have been hampered by mobility restrictions. Retail sales declined sharply in Q3 2021, reflecting limited consumer spending due to stay-at-home orders and voluntary social distancing to avoid contracting the virus. The contractions across almost all retail activities highlight the severity of the second COVID-19 wave, contrasting the resilience during the first wave in 2020.

The recovery in the hotel sub-sector has been halted by the second COVID-19 wave. Hotel occupancy rates had returned to pre-pandemic levels since December 2020 but fell sharply in September 2021. The air transport sub-sector continues to be the most severely affected amid border closures

Agriculture, communication, and health services have been resilient throughout the pandemic. Production of livestock and poultry, paddy, and aquaculture has increased significantly. The use of ICT for remote learning and working and the demand for government health services has also been strong.

Residential electricity demand increased in Q3 2021 after returning to normal levels in the first half of the year. By contrast, electricity use in the government and industrial sectors declined, reflecting shorter operating hours.

The trade balance improved markedly in Q3 2021, buoyed by soaring energy and petrochemical prices. Brent crude oil prices averaged US $73 per barrel in Q3 2021, a threefold increase from the troughs in April 2020, while petrochemical prices more than doubled.

Inflation edged higher in Q3 of 2021 but remains range-bound. Since January 2020, headline inflation has ranged between one and two and a half percent. However, prices of durable goods have increased sharply due to a shift in consumer preferences.

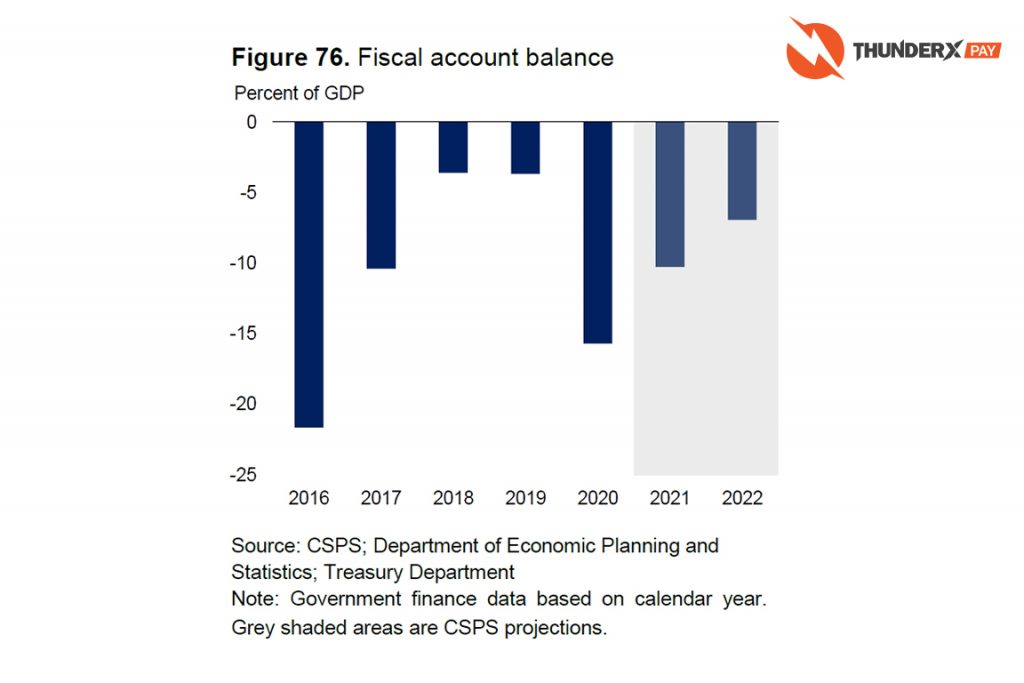

Domestic lending fell in Q3 of 2021 due to a decline in credit to households, particularly in personal loan financing. Credit to businesses has been more robust, with increased lending for agriculture, manufacturing, ICT, and commercial property development. The fiscal deficit narrowed in 2021 owing to higher oil and gas revenue. Total expenditure remains contained, but capital spending has been trimmed substantially whereas cuts to current spending were limited.

What we might expect in 2022?

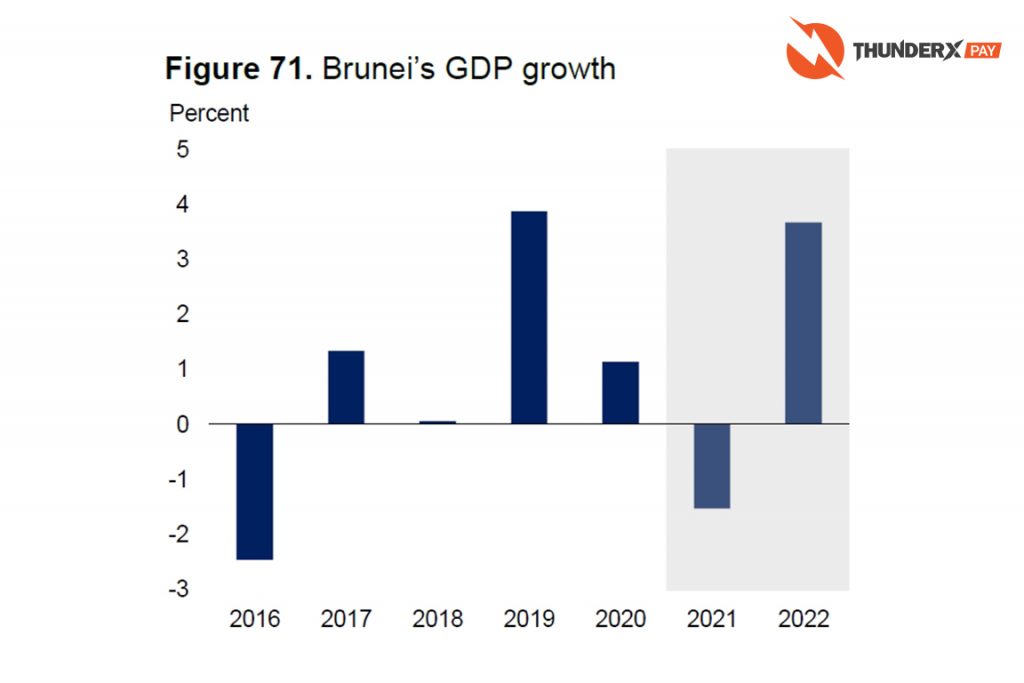

Brunei’s economy is forecast to expand by 3.7 percent in 2022, after contracting by an estimated 1.5 percent in 2021. Growth in 2021 is expected to be broad-based, largely supported by the downstream oil and gas and services sectors. Despite the growth rebound, the level of output remains well below pre-pandemic projections. The relatively high growth rate in 2022 partly reflects base effects, as real GDP has been lower than anticipated in the past two years due to the pandemic.

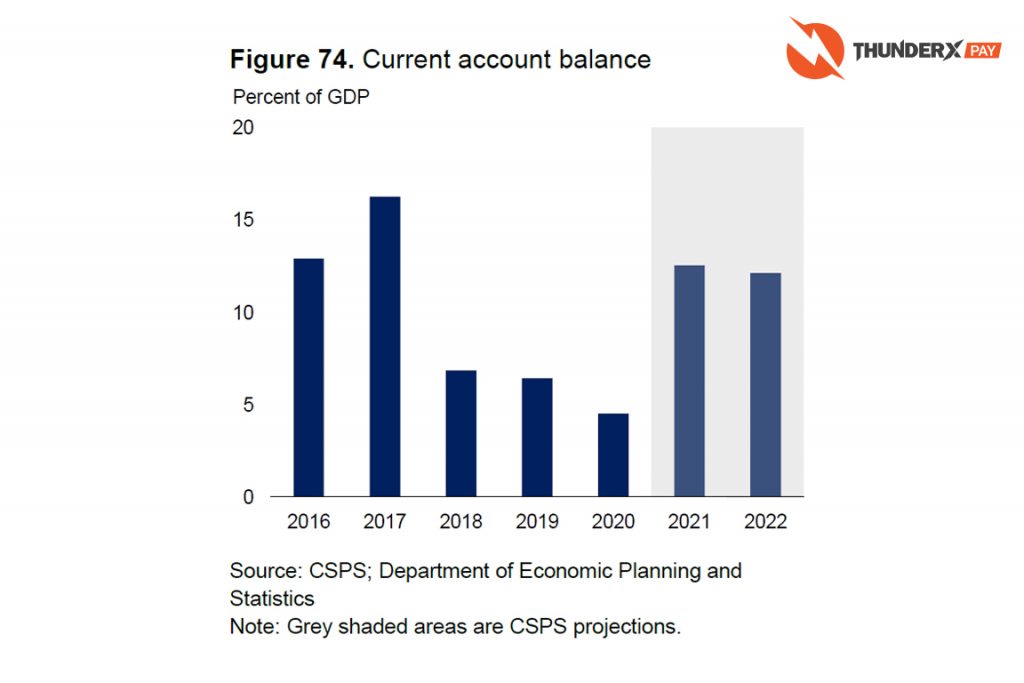

The current account surplus is expected to remain high in 2022, at 12.1 percent of GDP, owing primarily to crude oil, LNG, and refined petroleum and petrochemical product exports as external demand firms in line with global growth. The commencement of the production of fertilizers and increased aquaculture output is also expected to boost exports.

Following a significant reduction to an estimated 10.3 percent of GDP in 2021, the fiscal deficit is expected to shrink further to 6.9 percent of GDP in 2022. Oil and gas revenue is forecast to be higher, with crude oil prices averaging US $75 per barrel and LNG prices at US $14 per MMBtu. Government expenditure as a share of GDP is expected to continue to trend lower as fiscal consolidation efforts resume. Following two years of high prices, inflation is expected to fall to 1.3 percent in 2022. As global production capacity catches up to demand and supply bottlenecks ease, domestic prices are anticipated to fall gradually but remain high by historical standards. Brunei’s currency peg to the Singapore dollar and price administration through subsidies and price controls should keep inflation in check.

However, the baseline projections are subject to considerable uncertainty and could, again, be derailed by a materialization of several risks. These include a resurgence of the pandemic, prolonged supply bottlenecks, oil market uncertainty, and unanticipated domestic oil and gas supply disruptions.

This report recommends that the policy priorities should focus on driving economic recovery, especially in the worst-hit sectors, strengthening resilience including increasing investment in the public health system and intensifying digital transformation, enhancing fiscal space by expanding the revenue base and increasing spending efficiency, and advancing structural reforms such as building a more resilient education system, improving the business environment, and strengthening public service delivery.

Global economic activity is now above pre-pandemic levels, but recovery is incomplete.

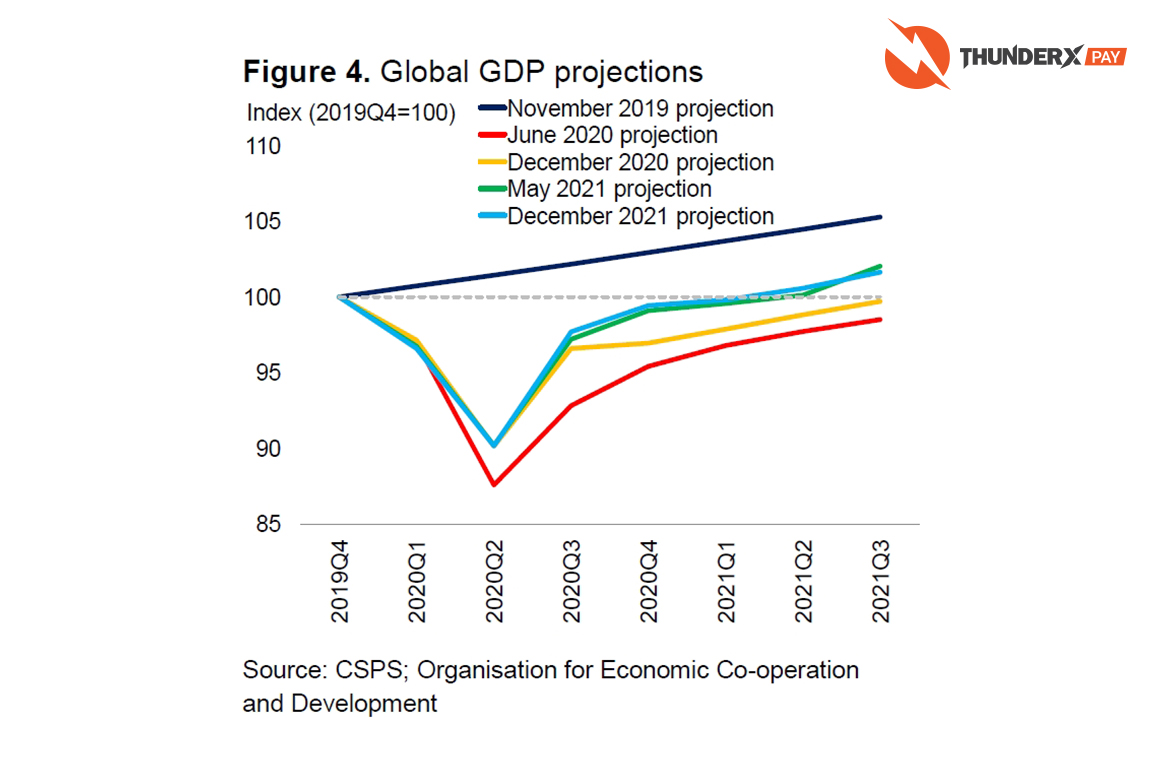

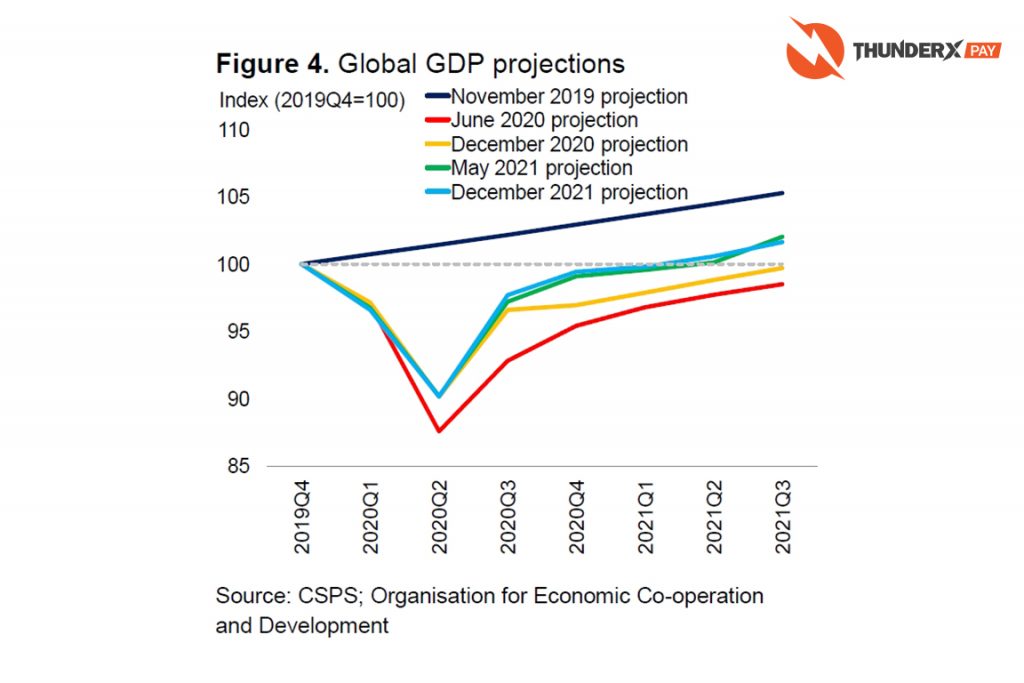

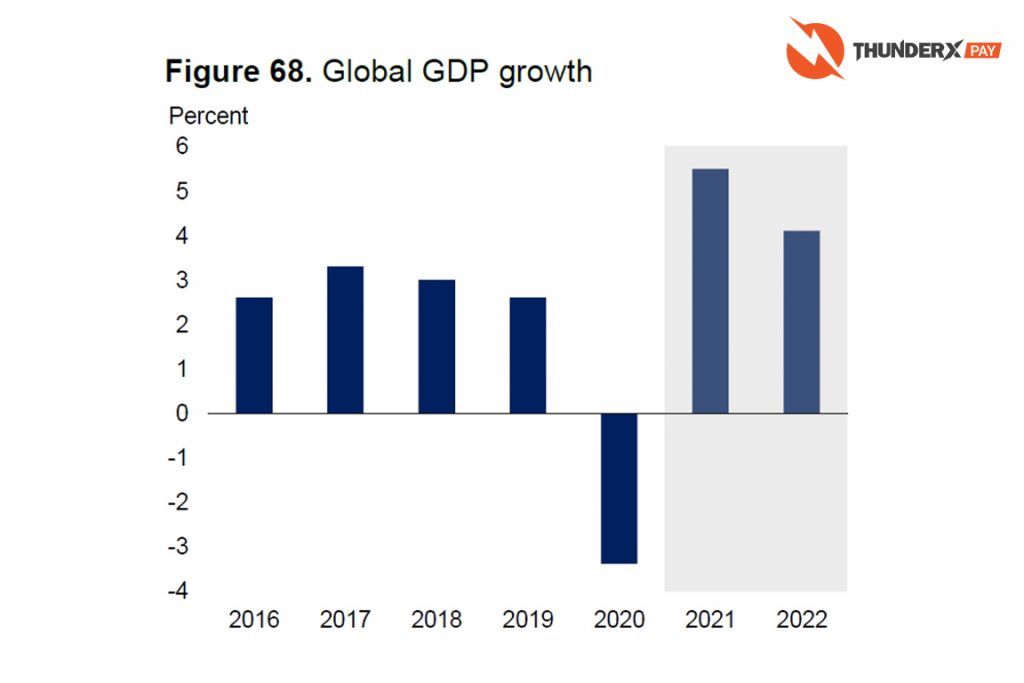

The recovery in global economic activity has been stronger than anticipated, with output projections progressively higher since mid-2020 (Figure 4). Global output is now above pre-pandemic levels, reflecting the success of public health measures, the rapid rollout of vaccines, and massive policy support for firms and households. After a 3.4 percent contraction in 2020, global growth is expected to surge to 5.5 percent in 2021, the fastest post-recession pace in 80 years. However, global output is still about 3.5 percent lower than it was before the pandemic. Moreover, this foregone growth has not been distributed equally, with a proportionately larger loss for low-income countries. Contact-intensive sectors and vulnerable groups, such as poor households, informal workers, and women, have been particularly hard-hit.

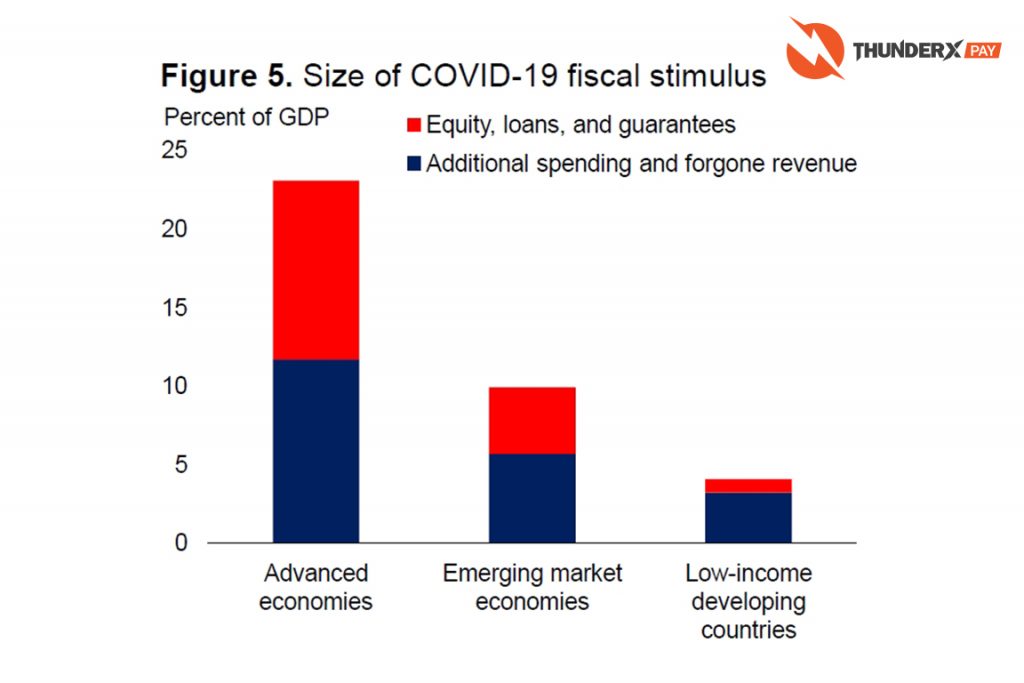

Differences in policy support also contributed to divergences in economic performance.

Swift and sizable fiscal stimulus in advanced economies supported firms and households during the pandemic and facilitated a strong rebound in economic activity (Figure 5).

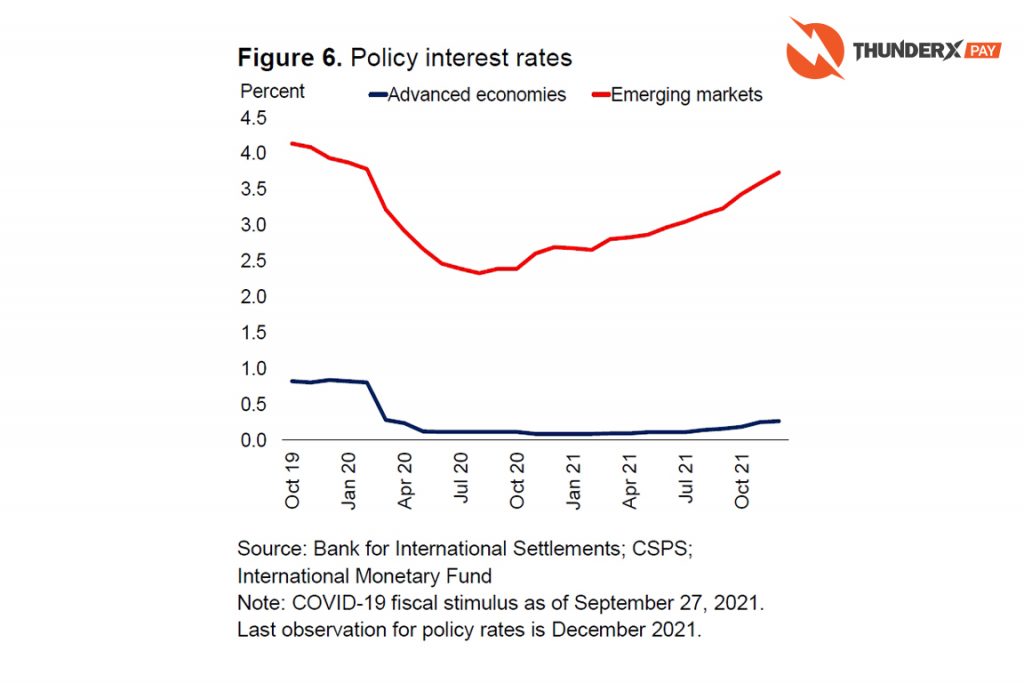

Financial conditions in advanced economies remain accommodative even as some central banks have reduced asset purchases and signaled plans to raise policy interest rates. In contrast, financing conditions in emerging markets have tightened somewhat as policy rates have been hiked to contain rising inflation and a currency depreciation (Figure 6).

Economic outlook and risks

Global growth is projected to decelerate to 4.1 percent in 2022, reflecting pandemic resurgence, waning policy support, and supply bottlenecks.

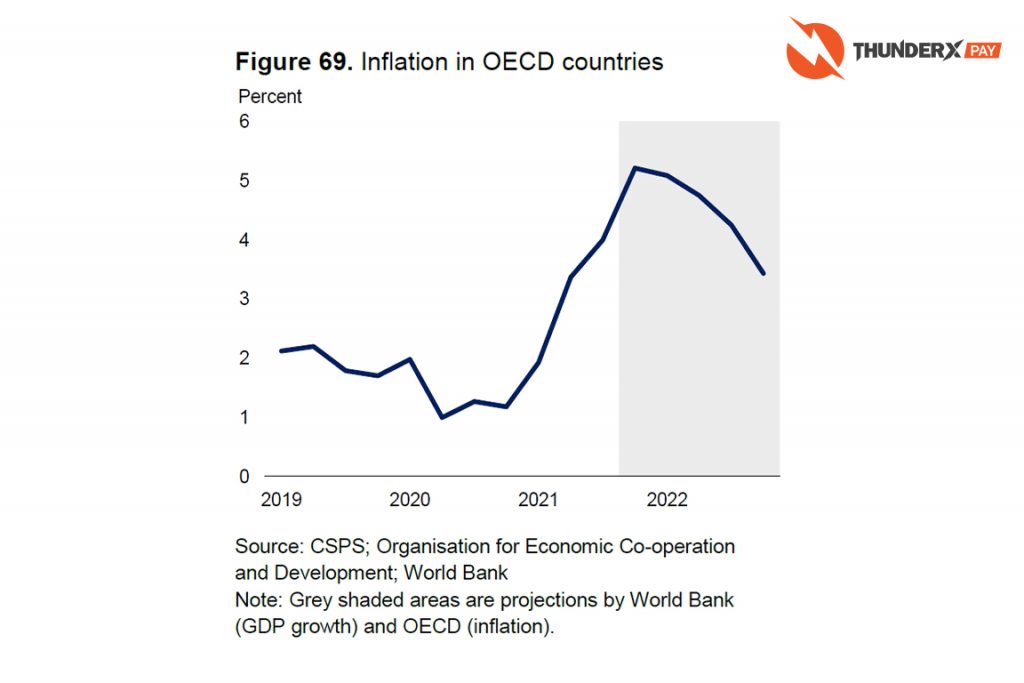

The global economy continues to recover, but the momentum has slowed due to pandemic resurgence and widespread supply disruptions. Global growth is expected to slow to 4.1 percent in 2022 from 5.5 percent in 2021, the fastest post-recession rate in 80 years (Figure 68). Inflation is projected to moderate but remain elevated, partly reflecting a gradual easing of supply bottlenecks (Figure 69). However, the Omicron variant may put upward pressure on prices if already stretched supply chains are disrupted further.

China’s economy is forecast to slow to 5.1 percent in 2022, after expanding by an estimated 8.0 percent in 2021 (Figure 70). Consumer spending is expected to be weighed down by recurring mobility restrictions owing to the country’s zero-COVID policy, while investment will be affected by regulatory tightening on the property and financial sectors.

After expanding by an estimated 5.6 percent in 2021, the United States’ growth rate is expected to slow to 3.7 percent in 2022. Economic activity is expected to face headwinds from COVID-19 outbreaks, lingering supply bottlenecks, acute labor shortages, and waning support from fiscal and monetary policy.

In the Euro area, growth is forecast to moderate to 4.2 percent in 2021, following a rebound of an estimated 5.2 percent in 2021. Growth is expected to be supported by strong service consumption and higher investments.

Japan’s growth is expected to accelerate to 2.9 percent in 2022, up from 1.7 percent in 2021. High vaccination rates have allowed for the lifting of pandemic-related restrictions and the release of pent-up demand.

Brunei’s economy is forecast to expand by 3.7 percent in 2022, with broad-based growth across sectors.

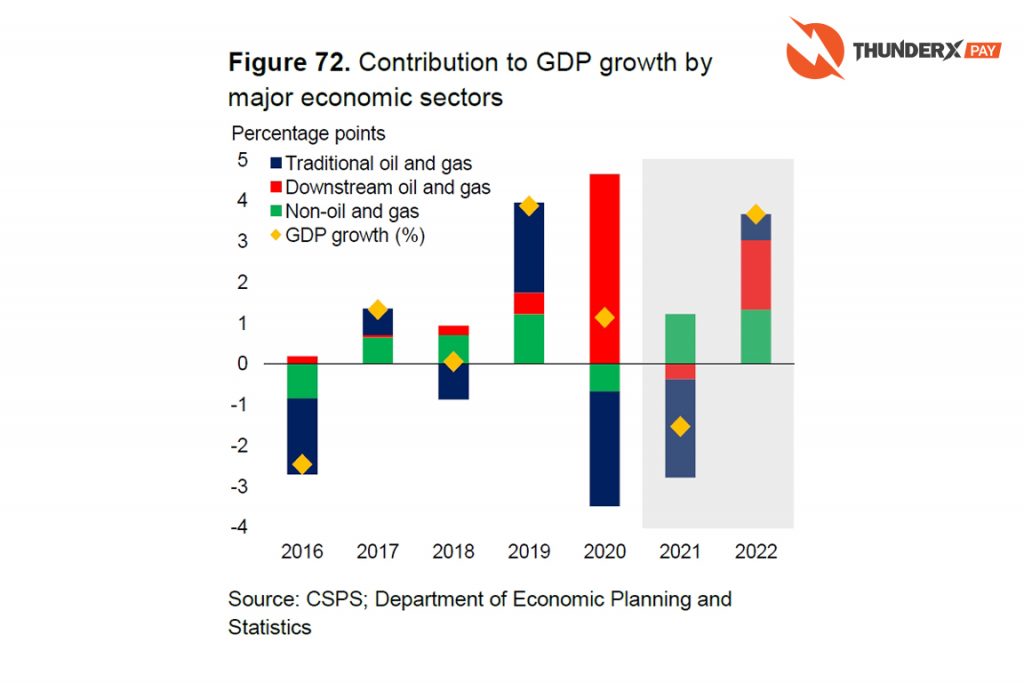

The traditional oil and gas sector, which comprises oil and gas mining and LNG manufacturing, is projected to grow by 1.2 percent in 2022, after contracting by an estimated 4.5 percent in 2021. Growth is expected to be supported by a marginal increase in supply, with crude oil production forecast at 109 tb/d and LNG production at 839 thousand mmbtu/d. Energy prices in 2022 are projected to be higher than in 2021 given the short global energy supply but are expected to fall from current highs. Crude oil prices are expected to average $75 per barrel, while LNG prices are expected to average $14 per MMBtu (Box 5).

The downstream oil and gas sector, which includes the production of petroleum and chemical products such as methanol and fertilizers, is expected to grow by about 30% in 2022 after declining by an estimated 6.3 percent in 2021. The sector was primed for strong growth in 2021 but has underperformed due to lower-than-expected petrochemical production and a delay in the commencement of a large fertilizer FDI project. Growth in 2022 reflects expectations of a pickup in demand for downstream products as the recovery in global activity continues apace. The start of ammonia and urea production in Q1 2022 is expected to significantly boost the downstream sector’s output. Meanwhile, construction of the second phase of Hengyi Industries’ oil refinery and the petrochemical plant has been pushed to 2023.

The oil and gas sector is projected to grow by 3 percent in 2022, following estimated growth of 2.9 percent in 2021. Most service sub-sectors are anticipated to gradually recover after containment measures restricted economic activities requiring physical interaction since Q3 2021. However, the recovery in tourism and travel is likely to be hesitant as impediments to international travel will remain until the COVID-19 pandemic is under control globally and unequal access to vaccines is addressed.

Despite the growth rebound, the level of output remains well below pre-pandemic projections.

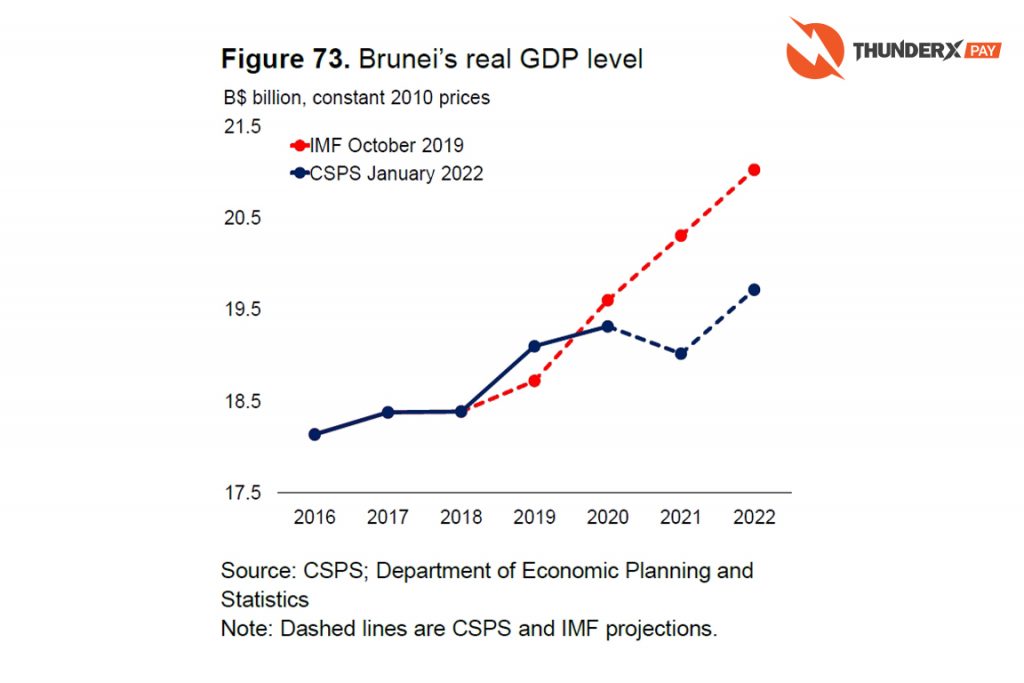

The seemingly high GDP growth forecast in 2022 partly reflects base effects, as real GDP has been lower than anticipated in the past two years. As such, the economic recovery is only partial. The level of output remains well below pre-pandemic projections, following two years of subdued growth (Figure 73). According to the International Monetary Fund’s October 2019 projections, the Brunei economy will grow by an average of 4% per year between 2020 and 2022, fueled primarily by growth in the downstream oil and gas and services sectors. However, these forecasts have been derailed by the pandemic, resulting in relatively weak external and domestic demand.

The current account surplus is projected to remain high due to a favorable trade balance.

Unexpected disruptions to domestic oil and gas production are a major downside risk. The volatility in the manufacturing of LNG and methanol partly reflects supply disruption of natural gas, which is an important input. A delay in the commencement of fertilizer production, which uses natural gas as feedstock, is another downside risk.

To illustrate the potential implications of the materialization of these risks, we consider the following downside scenario in 2022:

- A reduction of petrochemicals demand by 10 percent relative to baseline

- Crude oil prices at US$65 per barrel and LNG prices at US$11 per MMBtu

- Crude oil production at 105 tb/d and LNG production at 800 thousand mmbtu/d

In this scenario, Brunei’s GDP growth in 2022 is projected to be lower by more than two-thirds, at 1.1 percent. The current account surplus is projected to fall to 8.4 percent of GDP as net exports decline, while the fiscal deficit is projected to widen to 10.8 percent of GDP due to lower oil and gas revenue.

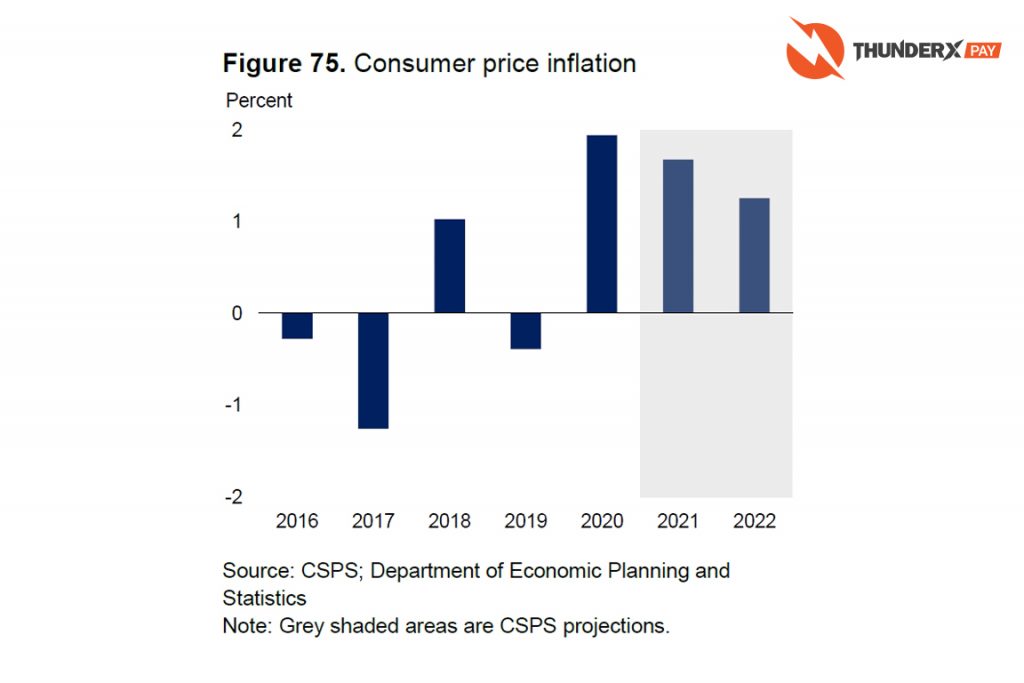

Inflation is expected to moderate but remain elevated by historical standards.

Consumer price inflation is projected to moderate in 2022 to 1.3 percent, following a slight easing from 1.9 percent in 2020 to an estimated 1.7 percent in 2021 (Figure 75). The high inflation observed in the past two years has been largely driven by global supply shortages and bottlenecks, which resulted in sharply higher prices for some imported items, ranging from fresh vegetables and meat products to motor vehicles. As production capacity catches up to demand and supply bottlenecks gradually ease, prices are anticipated to fall but remain at elevated levels. Brunei’s exchange rate may weaken against major currencies, given the expected tightening of monetary policy in most advanced economies. This could increase inflationary pressures from imported items. However, Brunei’s currency peg to the Singapore dollar and price administration through subsidies and price controls should keep inflation in check.

Risks to the outlook are tilted to the downside, including a resurgence of the pandemic, prolonged supply bottlenecks, oil market uncertainty, and unanticipated domestic oil and gas production disruptions.

The baseline forecasts are conditional on several factors. External demand for Brunei’s key exports is dependent on the evolution of the COVID-19 pandemic. One of the main downside risks is the emergence of new and more transmissible COVID-19 variants that are resistant to current vaccines, resulting in a need for new or modified vaccines or repeated booster doses. Stricter containment measures might have to be re-imposed under such circumstances, which would dampen economic recovery globally and domestically. The strength and duration of the recovery rest on the containment of the pandemic everywhere in the world. Unless unequal vaccine access is addressed through global cooperation, a full recovery is likely to be delayed.

Supply bottlenecks are expected to ease as capacity expands and pent-up demand fades. However, sporadic resurgences of the pandemic, particularly in Asia, may lead to production disruptions at various points in the global value chain. Moreover, renewed trade tensions could exacerbate ongoing supply disruptions. In this scenario, inflation could surprise on the upside, forcing central banks to tighten monetary policy earlier than anticipated. A tightening of financial conditions could elevate global uncertainty and trigger financial stress, which could have negative spillover effects on capital flows to emerging markets.

Uncertainty in the oil market could be detrimental to the fiscal sustainability of oil-exporting countries. A resurgence of the pandemic remains a key downside risk to global oil demand and oil prices, which directly affects Brunei’s exports and government revenue. The high volatility in oil prices has also been due to challenges in controlling production levels under the OPEC+ agreement. Prospects for price stability are dependent on the level of cooperation among large oil producers.

Unexpected disruptions to domestic oil and gas production are a major downside risk. The volatility in the manufacturing of LNG and methanol partly reflects supply disruption of natural gas, which is an important input. A delay in the commencement of fertilizer production, which uses natural gas as feedstock, is another downside risk.

To illustrate the potential implications of the materialization of these risks, we consider the following downside scenario in 2022:

- A reduction of petrochemicals demand by 10 percent relative to baseline

- Crude oil prices at US$65 per barrel and LNG prices at US$11 per MMBtu

- Crude oil production at 105 tb/d and LNG production at 800 thousand mmbtu/d

In this scenario, Brunei’s GDP growth in 2022 is projected to be lower by more than two-thirds, at 1.1 percent. The current account surplus is projected to fall to 8.4 percent of GDP as net exports decline, while the fiscal deficit is projected to widen to 10.8 percent of GDP due to lower oil and gas revenue.

Policy priorities should focus on driving economic recovery, strengthening resilience, enhancing fiscal space, and advancing structural reforms.

Looking ahead, the policy priorities should focus on driving economic recovery, especially in the worst-hit sectors; strengthening national resilience by prioritizing public healthcare and accelerating digital transformation; enhancing fiscal space to ensure fiscal sustainability; and advancing structural reforms to build a more competitive, resilient, and inclusive economy.

Pandemic containment measures have affected firms and households. In the near term, it is essential to avoid a premature unwinding of economic support and relief measures to ensure recovery remains on a strong footing. The travel and tourism sectors have been badly hit by the pandemic. The government can help to revitalize these sectors by promoting domestic tourism, working with regional partners to establish travel corridors with harmonized standards around the recognition of vaccination certificates and digital contact tracing, and extending financial or fiscal measures to support operating at lower capacities. Targeted social spending for vulnerable and disadvantaged households should also remain in place until their financial situation improves.

Strengthening national resilience should start with the public health system. In addition to ensuring the availability of vaccines, therapeutics, and medical supplies in preparation for future COVID-19 waves, it is essential to make the prevention and control of noncommunicable diseases (NCDs) a top priority. The incidence of NCDs in the Brunei population remains at a very high level, and the COVID-19 pandemic has highlighted that people with underlying health conditions, such as NCDs, have a higher risk of severe disease. The pandemic has also shown that digital preparedness can help firms to navigate and adapt to changes in the operating environment. To prepare for future disruptions, digital transformation should be intensified, including developing 5G infrastructure. MSMEs should be encouraged to adopt digital solutions and the government can facilitate and provide the necessary support for the transition. It is also vital to equip the workforce with digital and technological skills to secure decent jobs in the digital era. Lifelong learning through reskilling and upskilling is particularly important.

The short-term priority for fiscal policy is to contain the pandemic, stimulate the economy, and provide relief to firms and households. Over the medium term, ensuring sustainability is the primary focus. Fiscal buffers have deteriorated after seven consecutive years of budget deficits. The revenue base has to be broadened beyond oil and gas. Immediate tax actions can include raising or introducing excises on products with negative health or environmental impact. This would be more feasible compared to other tax options. Enhancing spending efficiency should also be continued, which may include containing the high public wage bill, improving the targeting of social spending, and reviewing policies on blanket subsidies to make them more targeted.

Structural reforms are needed to build a more competitive, resilient, and inclusive economy. They are also critical to remedying the scars from the pandemic-induced crisis and preparing for future crises. Enhancing human capital and building a more resilient education system should be a policy priority, which can include more effective remote learning, providing remedial classes to reverse learning losses, and closing the education gap and digital divide among socioeconomic groups. Initiatives to foster a business environment that is conducive to trade and investment should continue to be a priority, including improving trade facilitation and strengthening public service delivery by digitalizing work processes.

Published 27/06/2022

By Michael Saichuk