Since the US has faced an inflation rate hit 8.6% which is the highest in 40 years, the FED has consideration to increases the interest rate, and the latest update on the interest rate is rose to 0.75% after they had seen the inflation report of May.

Accordingly, How will this impact Thailand? The signal to increase the interest rate is the same as the FOMC meeting recently. The governor of the Bank of Thailand, Dr. Sethaput Suthiwatanaraput said about monetary policy “The interest rate in Thailand is the lowest in the region, but inflation in Thailand is the top rank in the region, so the monetary policy that they use considerately.” This quote was analyzed that the interest rate in Thailand will increase exactly, at present the interest rate is 0.5% but the inflation rate hit 7.1% which is the highest 13 years ago. On 8 June 2022, during the meeting The Monetary Policy Committee has a 4:3 solution to keep the interest rate at 0.5%, the votes were significant which affected 3 committees has considered increasing the interest rate.

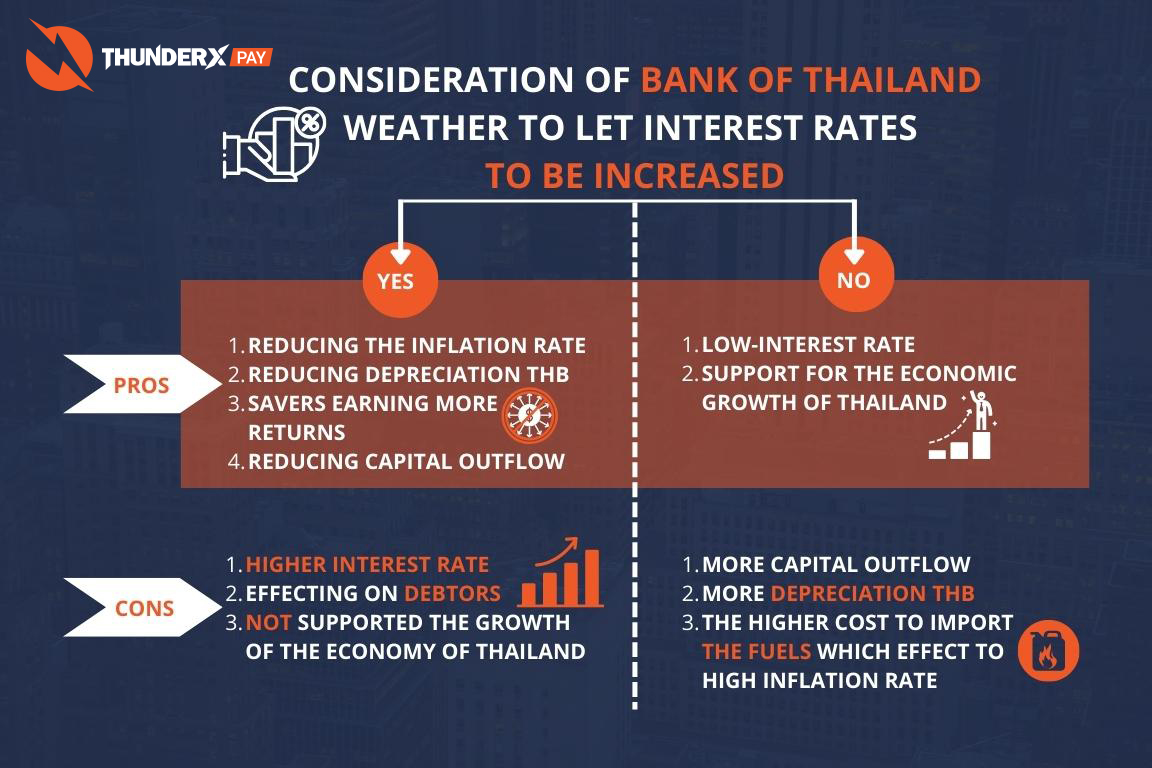

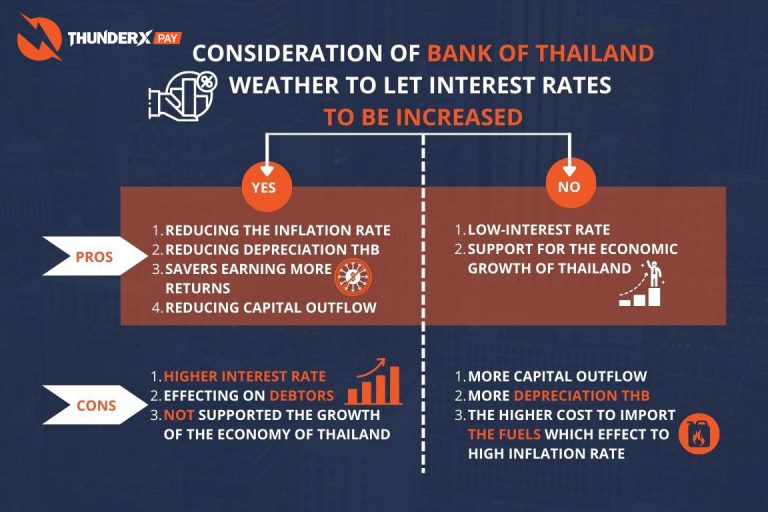

This infographic is described as the following details which considered whether BOT will considered to increased due to the impact of FED;

For this case, BOT has considered increasing the interest rate

Advantage | Disadvantage |

|---|---|

1. Reducing the inflation rate | 1. Higher interest rate |

2. Reducing depreciation THB | 2. Effecting on debtors |

3. Savers earning more returns | 3. Not supported the growth of the economy of Thailand |

4. Reducing capital outflow |

For case, BOT hasn’t considered increasing the interest rate

Advantage | Disadvantage |

|---|---|

1. Low-interest rate | 1. More capital outflow |

2. Support for the economic growth of Thailand | 2. More depreciation THB |

3. The higher cost to import the fuels which effect to high inflation rate |

The opinion from economists about the monetary policy in Thailand is that BOT tends to increase the interest rate within this year, which may increase 1-2 times and increase the interest rate by 0.25% per time, to manage the high inflation rate. The causes of BOT will increase the interest rate are the following;

- Reducing the depreciation of the Thai Baht (THB), this cause affects the higher cost of importing goods, and also fuel costs.

- According to the labor sector, It has been expected to increase wages in order to cope with the higher inflation rate. If this low wages or unemployment situation is still continuing, will be occurred a chance of higher risks in the inflation rate.

Published 29/06/2022

By Windy K.