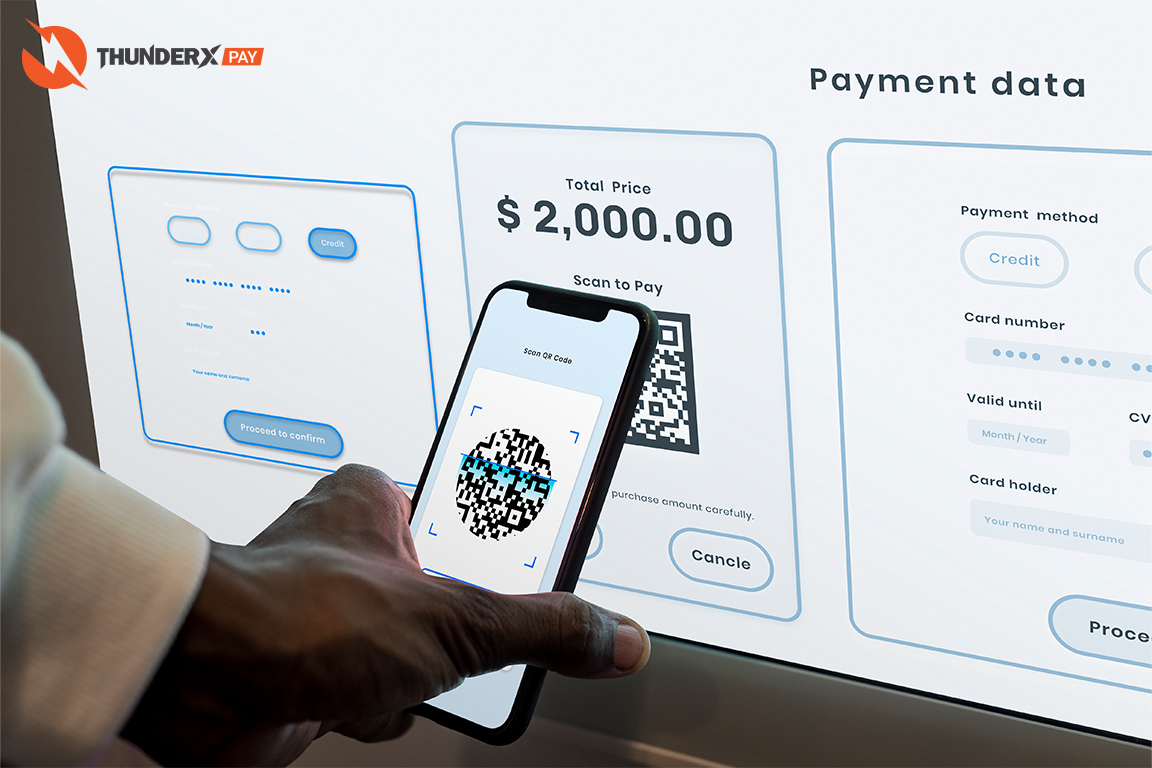

Payment Gateway

Nowadays, Payment gateways have been used to accept purchases from customers, potentially growing the merchant business. It is a tool used by merchants to receive payments from customers which is cloud-based and it helps merchants receive online payments from customers. Moreover, a brick-and-mortar retail store’s payment gateway is a point-of-sale (POS) system. Globalization drives businesses to transact more frequently across borders. Consumers are also transacting more globally buying from foreign eCommerce sites and traveling, living, and working abroad. E-commerce and other online transactions are growing even more rapidly since the beginning of the COVID-19 pandemic, with particularly strong trends across many emerging markets. What is a payment gateway? A payment gateway is a technology used by merchants to accept any payment method from customers provided by an e-commerce application service provider to which a merchant’s website or a physical point-of-sale POS system is connected. A payment gateway often connects several acquiring banks and payment methods under one system. It transmits transaction information virtually through web payment services and APIs or