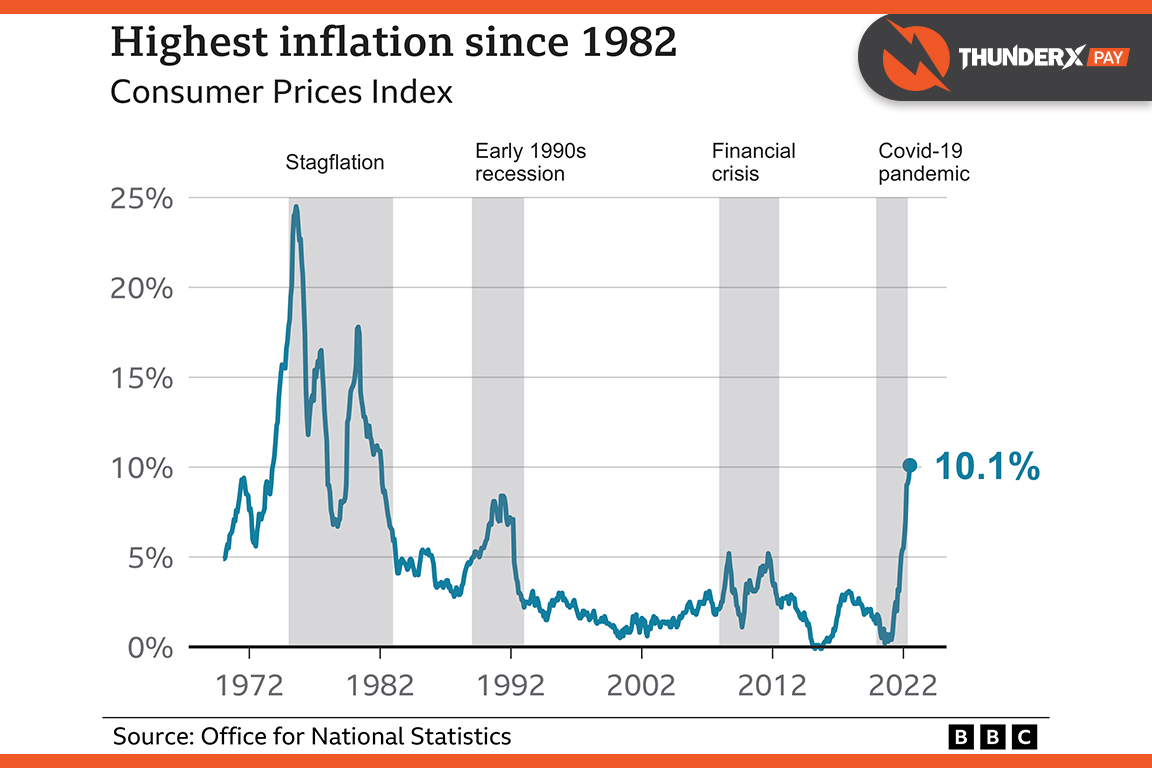

The inflation rate in the UK dramatically hit a new 40-year high record

The Office for National Statistics (ONS) published the data on Wednesday 17 August 2022 that the inflation in the UK was rising above 10% for the first time since 1982, it was hitting the new highest record of 10.1% when compared with the same month last year, up from 9.4% in June. The main factor driving inflation in the UK hike is the pricing of foods and non-alcoholic drinks, the price of bread, cereals, milk, cheese, eggs, vegetables, meats, and chocolates. However, the Bank of England adjusted the interest rate 6 times continuously in order to control inflation, at the beginning of August the bank of England adjusted the inflation rate rose to 0.50%, and it was hiked for 27 years since 1995. The inflation in the UK is forecasted to go even higher at the end of this year, driven by electricity prices and gas prices, because at the end of the year is the winter season, and would