Without stopping, FED raises 0.75% interest rates

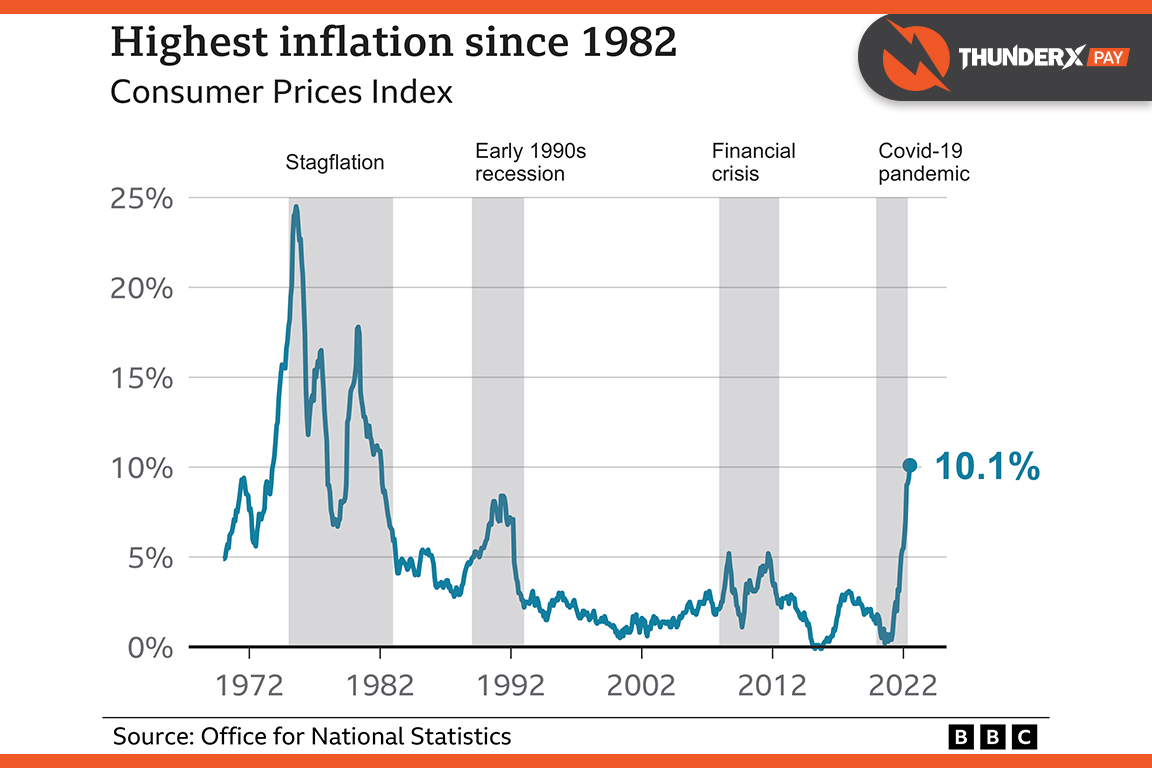

On 21 September 2022, the federal funds rate brings it to a range of 3% to 3.25%, the highest it’s been since 2008 announced by the FED during a news conference following a meeting of the Federal Open Market Committee (FOMC). It was the 5th increase in the interest rate this year. In this resolution in order to reduce US inflation since 1980, the employment rate tends to be increased which increasing the interest rate might also increase the recession as well. The central bank signaled more raises to come, predicting rates would reach 4.4% by the end of the year and not start coming down until 2024. In addition, The Central bank around the world would raise interest rates sharply as they too attempt to attack the cost of living crisis. This hike made the Baht weaken. On the same day, the Baht was recorded to depreciate in 16 years which is 37.34 THB/USD. Thailand’s finance minister says his country is in no hurry to